california sales tax payment plan

Taxpayers are still required to by Wisconsin law to pay their sales tax amount owed by the original due dates on March 31 2020 and April 30 2020. Pay a 34 set-up fee that the FTB adds to the balance due Make monthly payments until the taxpayer pays the entire tax bill in full Pay by.

New Luxury Homes For Sale In Porter Ranch Ca Hillcrest At Porter Ranch Beacon Collection

California sales tax is a minimum of 725.

. Get a Sellers Permit. Sales Use Tax in California Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. Sales.

The undersigned certify that as of June 18 2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in. Make your check or money order payable to the. 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California.

The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted. To continue with the above example imagine that you prove to the state that you can only afford to pay 300 per month. Special Taxes.

Pay Pay California counts on all of us Pay Payment options Penalties and interest Collections Withholding If you cannot pay Make a payment Bank account Credit card Payment plan More payment options You may be required to pay electronically. As an individual youll need to pay a 34 setup fee that is added to your balance when setting up a payment plan. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services.

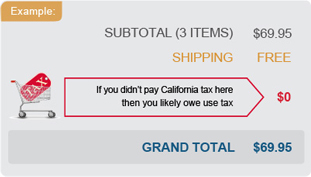

There is a statewide county tax of 125 and therefore the lowest rate anywhere in California is 725. California Announces Sales Tax Payment Plan for Small Businesses BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales taxes that they have collected from customers. California sales tax payment plan Tuesday July 5 2022 You may be required to pay electronically.

This payment plan option is available to businesses with less than 5 million in annual taxable California sales. This is only an extension on time to file not pay. After making the 2500 downpayment and 12 months of 300 installments you still owe 3900 on your tax bill.

A Sellers Permit is issued to business owners and allows them to collect tax from customers and report it to the State. Requires taxpayers to remit all tax payments electronically regardless of the taxable year for which the payment applies once any estimated tax or extension payment exceeds 20000 or their tax liability exceeds 80000 for any taxable year beginning on or after January 1 2009. But you might be well over 10 depending where youre shopping.

Discover How EY Assists Businesses by Providing Scalable Tax Services for Their Tax Needs. Wisconsin businesses can request to pay sales and use tax returns due April 30 2020 by June 1 2020 instead. Change or cancel a payment plan To change your current installment agreement call us at 800 689-4776.

Businesses meanwhile are typically required to pay off whats. All payment plans must be. An application fee of 34 will be added to your tax balance when you request an installment agreement.

Mortgage Calculator Rent vs Buy Closing Costs Calculator Helpful Guides. The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement. Property owners impacted by recent California fires may be eligible for property tax relief please visit our disaster relief webpage for additional information.

Effective December 15 2020 small business taxpayers with less than 5 million in taxable annual sales can take advantage of a 12-month interest-free payment plan for up to 50000 of sales and use tax liability only. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. In some cases the state may allow you to make payments for 12 months and renew the payment plan. California Announces Sales Tax Payment Plan for Small Businesses BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales.

Box 2952 Sacramento CA 95812-2952. Get started today with a free trial and a developer-friendly integration. Ad Download Or Email FTB 3567 C2 More Fillable Forms Register and Subscribe Now.

For the approximate 995 of business taxpayers below the 1 million threshold for their current California sales and use tax obligation returns for the 1st quarter 2020 will now be due on July 31 2020. You can request a payment plan and pay down your balance over time. Visit Mandatory e-Pay What you may owe You filed tax return You received a letter Estimated tax payments.

Using our online services you can file a return make a payment submit a claim for refund file an appeal and much more. Here S When Married Filing Separately Makes Sense Tax Experts Say. Range of Local Rates 0 325.

Ad Try Avalara to see how sales tax automation makes compliance easier than manual systems. We have listed the combined statecounty rate as the state rate to eliminate confusion. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO.

Payment plan requests can be made through the CDTFA online services system. If your request is accepted you will receive a notice with your monthly payment due date and amount. Sales tax payment plan for small businesses For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12-month interest-free payment plan for up to 50000 of sales and use tax liability.

Under the payment plan qualifying businesses can enter into a payment plan to distribute up to 50000 of sales tax liability over a 12-month period interest-free and penalty-free. Simplified income payroll sales and use tax information for you and your business. If you have an online services profile log in with your username and password to our secure website to get started.

State Sales Tax Rates State Rate 7250 Note that the true California state sales tax rate is 6. Providing a three-month extension for a tax return or payment to any businesses filing a return for less than 1 million in tax. Failure to comply with this requirement will result in a.

Businesses that dont fall within these parameters can contact the CDTFA. We offer a variety of online services that make completing your CDTFA business easy and efficient.

State And Local Sales Tax Information Https Www Taxjar Com States Wisconsin Sales Tax Business Tax Deductions Small Business Tax Deductions Sales Tax

Ifta Fuel Tax Returns Global Multiservices Tax Return Global Renew

California Equity Compensation Table Tax Credits State Tax Equity

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Greensboro Internal Revenue Service Irs

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Irs Taxes Tax Debt Relief Tax Debt

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

M Tax Resolution Irs Installment Agreement Taxes Payroll Taxes Tax Services Irs Taxes

Installment Payment Agreement Template Business

All You Need To Begin Your Business In Tupperware Is A 30 Investment And You Get Everything You Need And Me Go Tupperware Consultant Tupperware Good Meaning

California Moves Toward Creating Business Tax Break Review Board Https News Bloombergtax Com Daily Tax Report California Moves Toward Cr Law Scammers Sayings

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Irs Taxes Lakeview Michigan Mmfinancial Org 800 856 5401 Irs Taxes Tax Debt Internal Revenue Service

California Property Tax Calculator Smartasset Com Income Tax Property Tax Paycheck

Irs Partial Payment Installment Agreement Texas M Financial Consulting Inc Financial Blog Cleburne

Vehicle Purchase Agreement With Monthly Payments Template